Last Updated on 2021-08-02 by Admin

Notes

Options are contracts where you have the right but not the obligation to either buy (call ) or sell (put) financial instruments at the exercise (strike) price on or before a predetermined date.

Types

- American

-

- Can exercise the option any time up to the expiration date.

- Higher risk to the seller (writer).

- More expensive (premium) than the European type option.

- Options traded on the ASX are predominantly American type.

- European

-

- Can exercise the option only on the contract expiration date.

- Lower risk to the seller (writer).

- Less expensive (premium) than the American type option.

Strategies

- Vertical Bull Spread

- Call Bull Spread

- Vertical Bear Spread

- Put Bear Spread

- Straddle

-

- Long Straddle

- Short Straddle

- Strangle

-

- Long Strangle

- Short Strangle

- Barrier Option

- 1 Option Contract: 100 Shares

- Seller (Writer):

- Buyer (Taker):

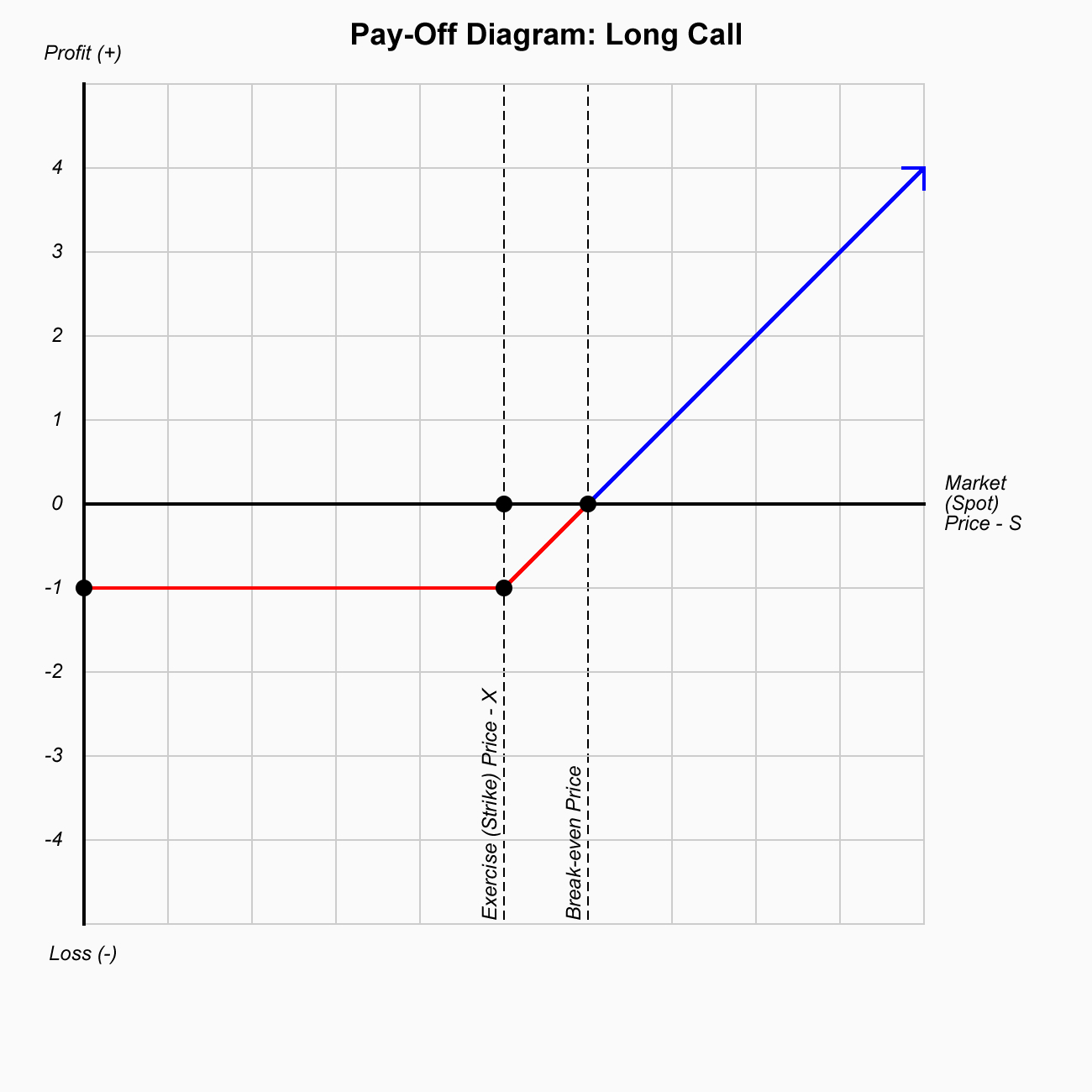

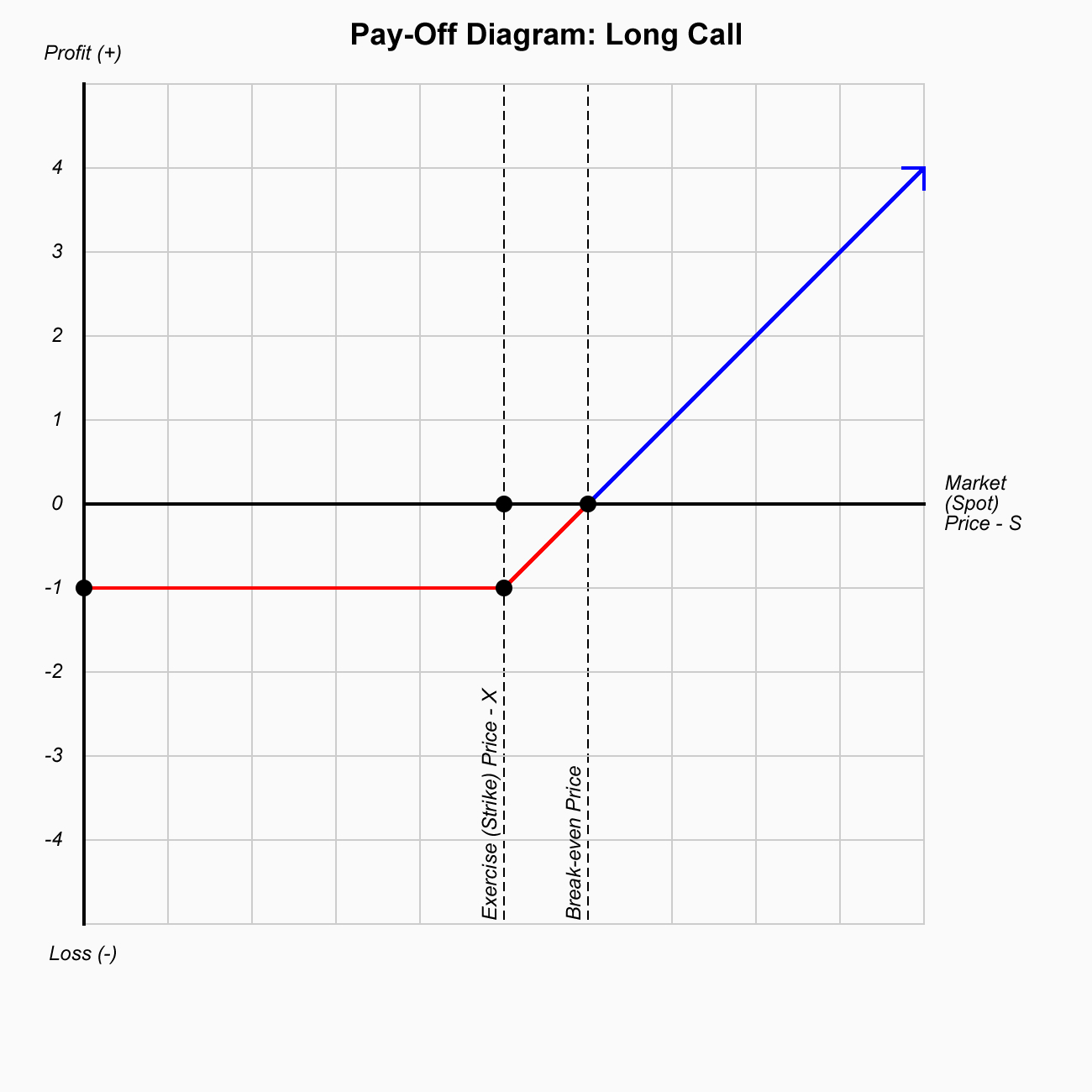

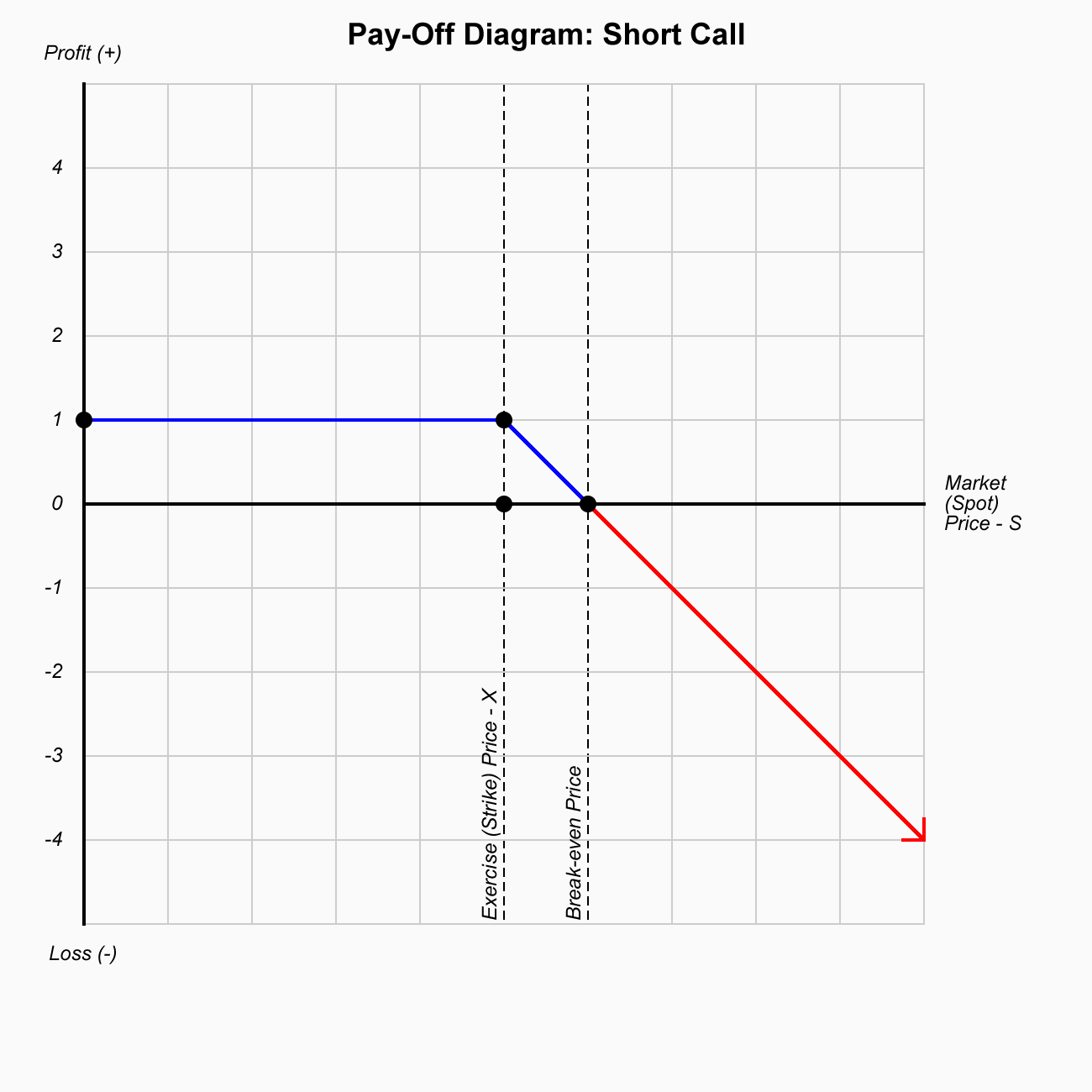

- Call (Buy) Option: The right but not obligation to buy the financial instrument at the exercise (strike) price.

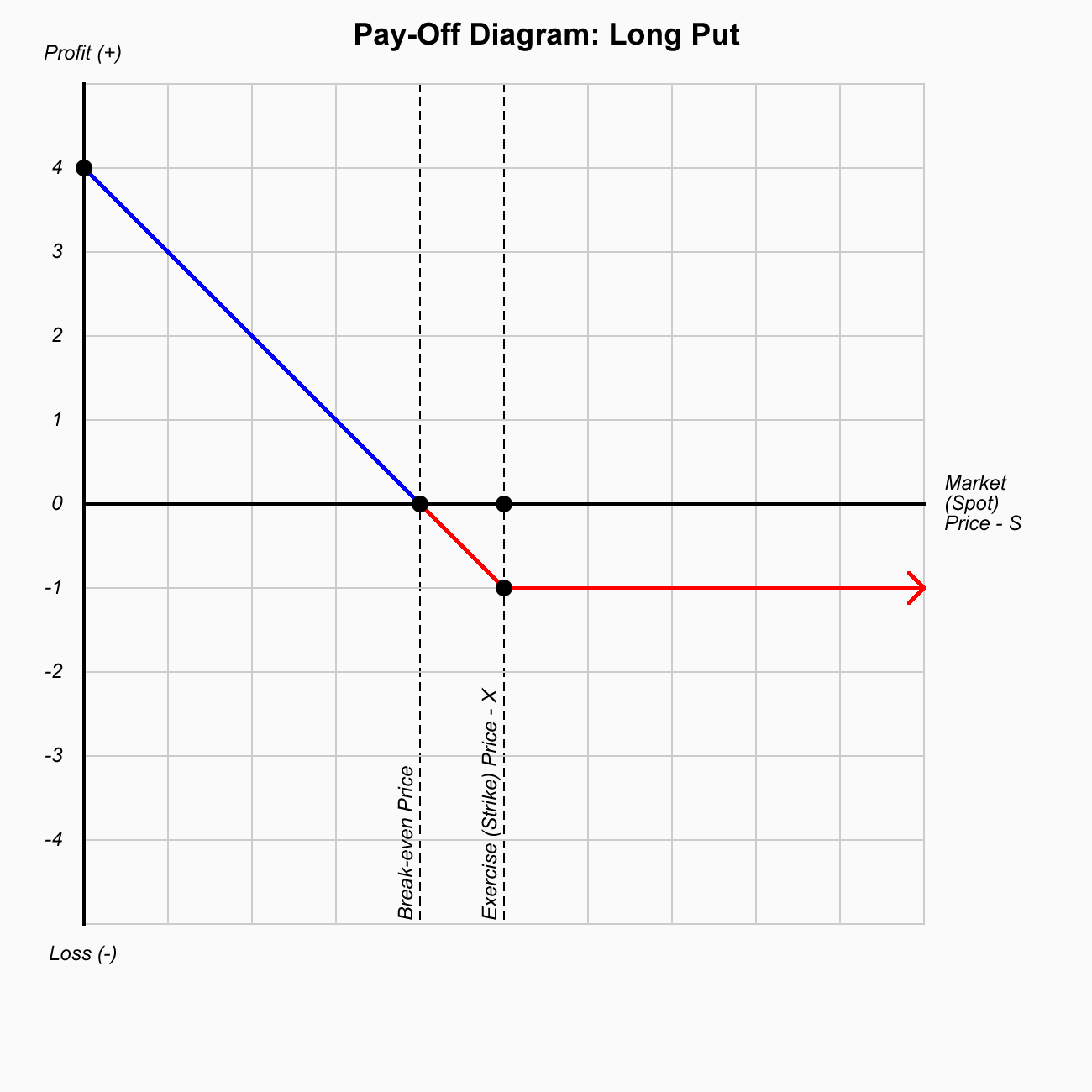

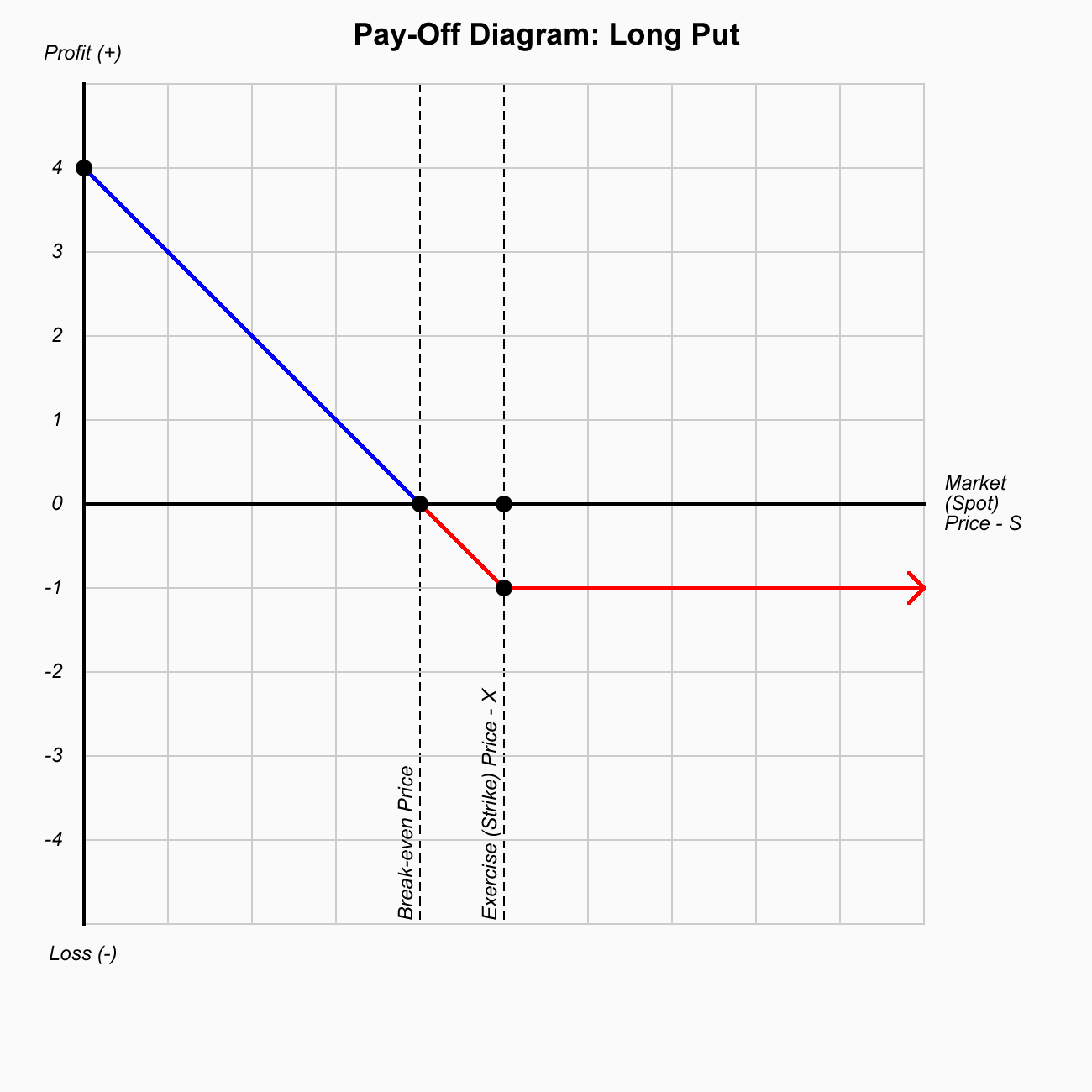

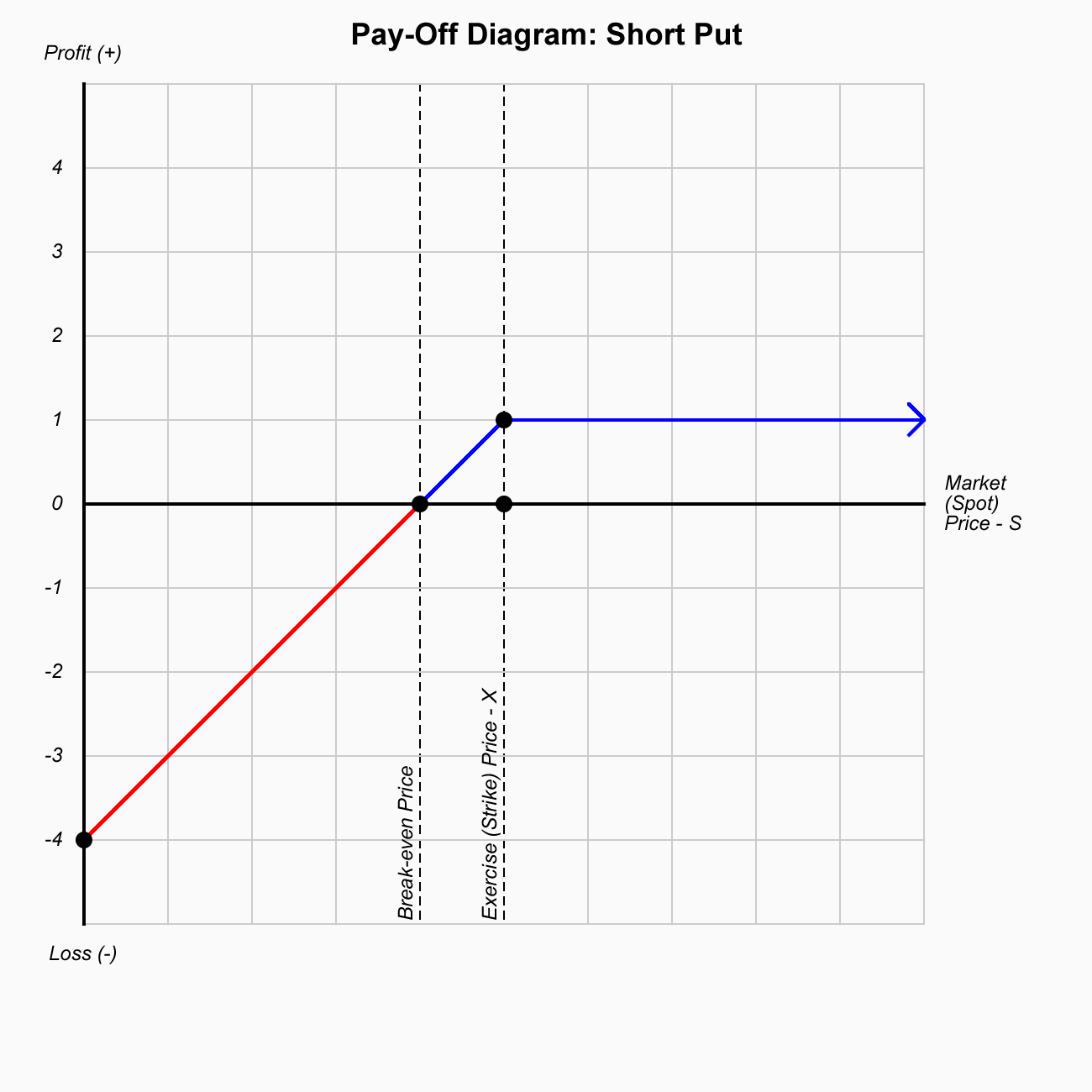

- Put (Sell) Option: The right but not obligation to sell the financial instrument at the exercise (strike) price.

- Premium:

-

- How much you pay for the contract.

- The level of risk is reflected in the premium of the option.

- Exercise (Strike) Price: The agreed price on the contract.

- Moneyness:

-

- In The Money (ITM): Profit

- The Strike Price of a CALL OPTION is below the market price.

- At The Money (ATM): Break-Even

- Out of The Money (OTM): Loss

- Deep In The Money: Large Gain

- An option that would lead to a large profit if it were exercised

- Covered Option: The writer owns stock to be able to fulfill the contract.

- Naked Call Option: The writer does not own stock to fulfill the contract which is underwritten by a third party.

- Option Contracts:

-

- Exchange Traded Options (ETOs)

- Over-The-Counter (OTC)

- Intrinsic Value

- Price Volatility

- Issued By:

- Issued To:

- Type of Security:

- Duration:

- Source:

- Market:

- Return:

- Principle:

- Liquidity:

- Risk Level:

Calculation

$$V = max(S-X, 0)-P $$

Long Call

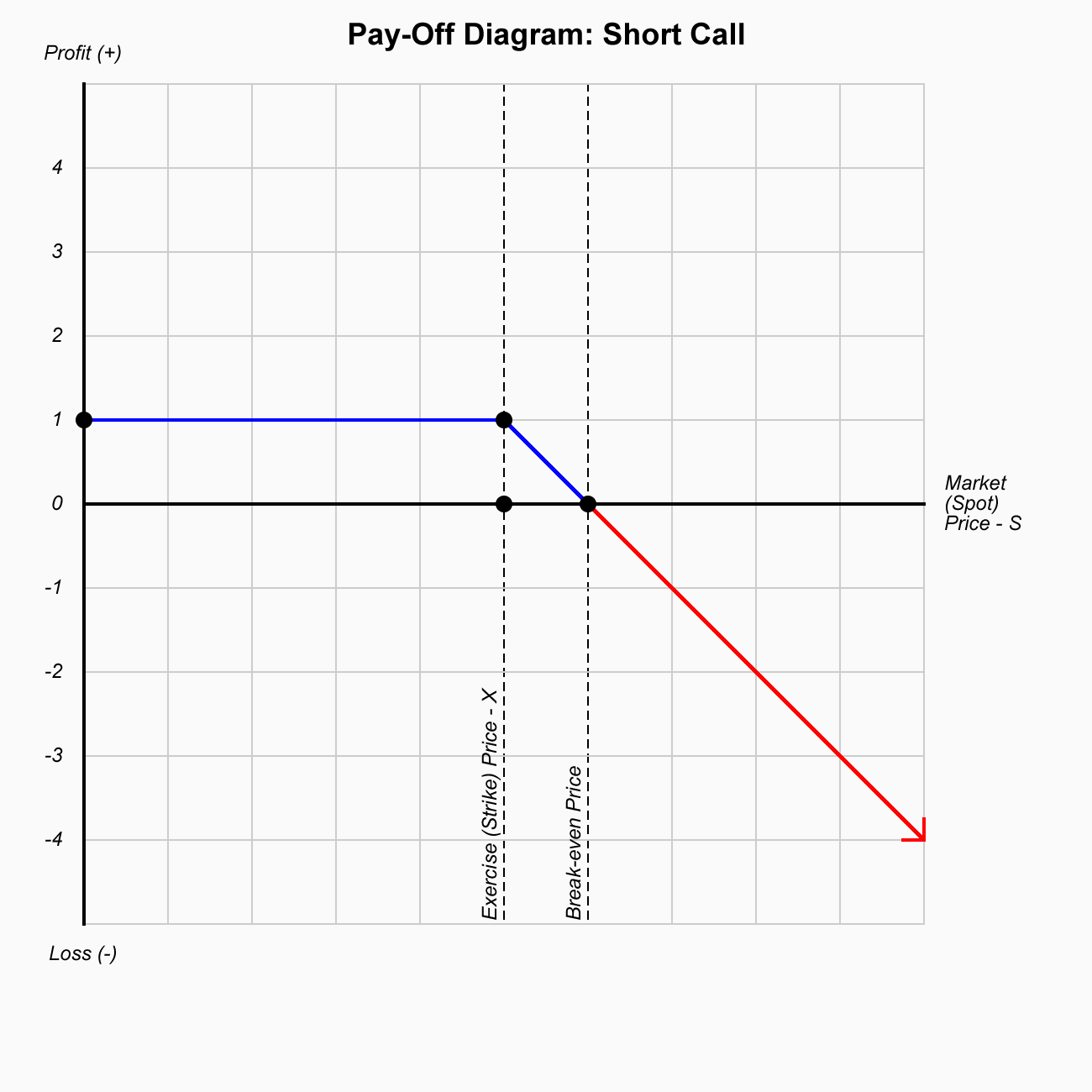

Short Call

Long Put

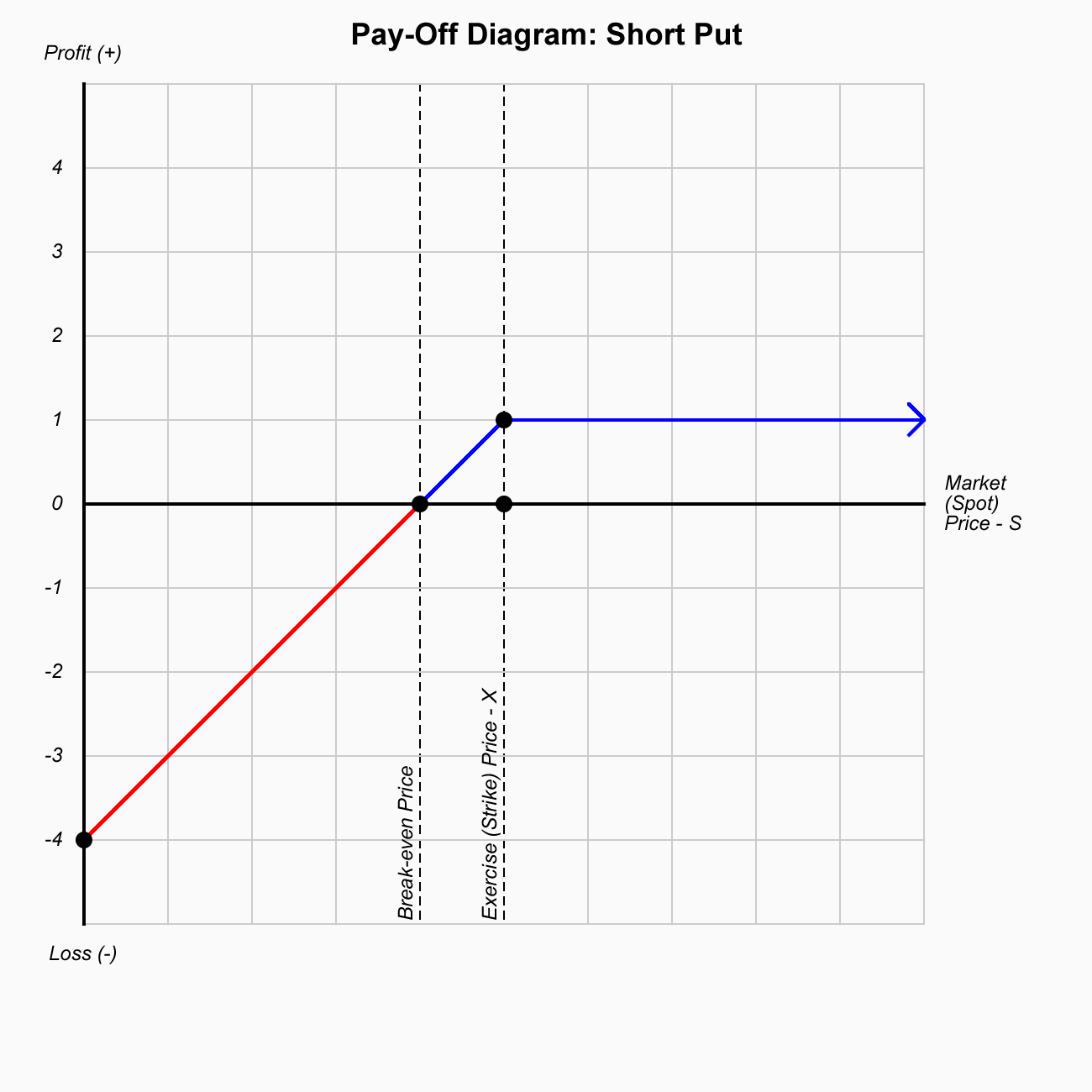

Short Put

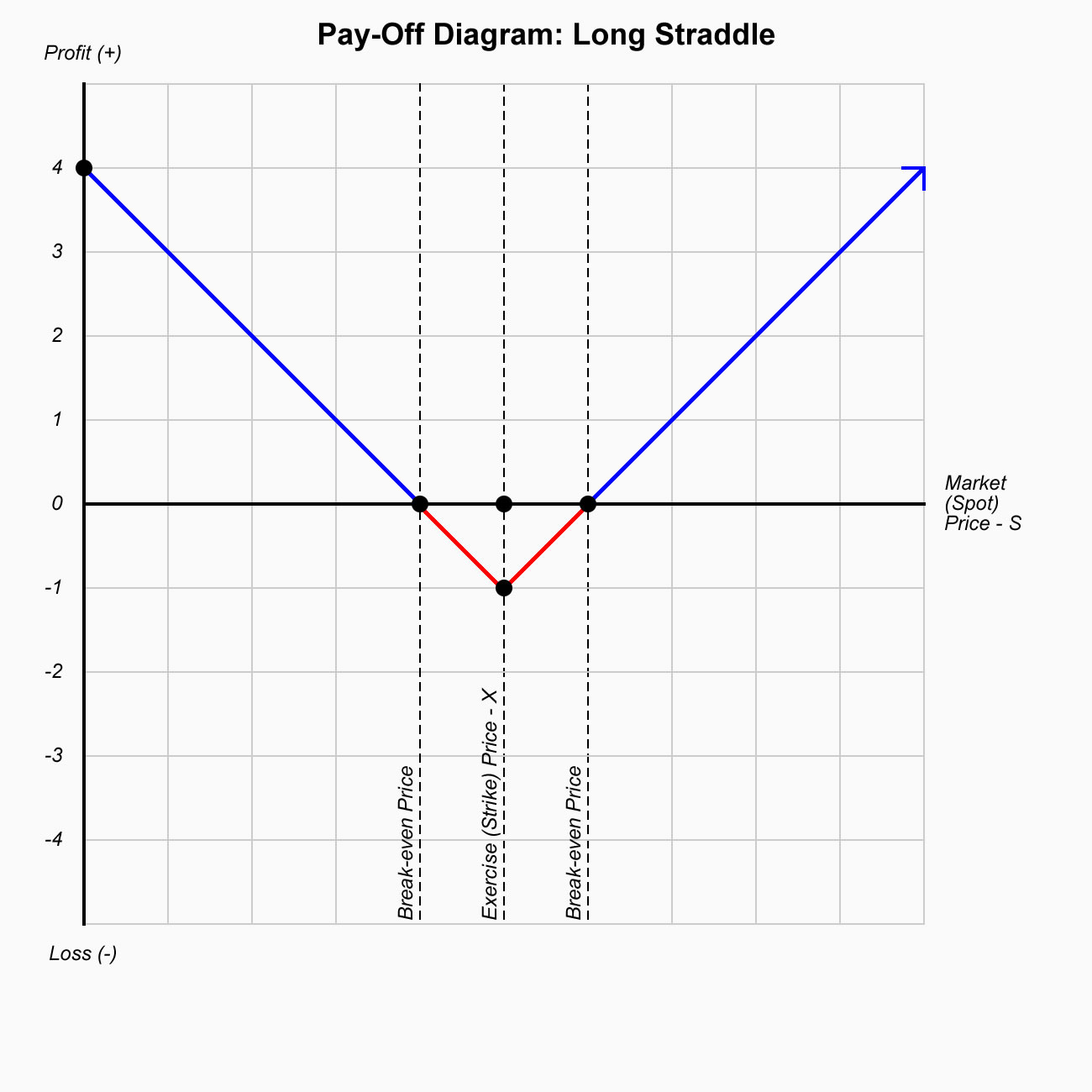

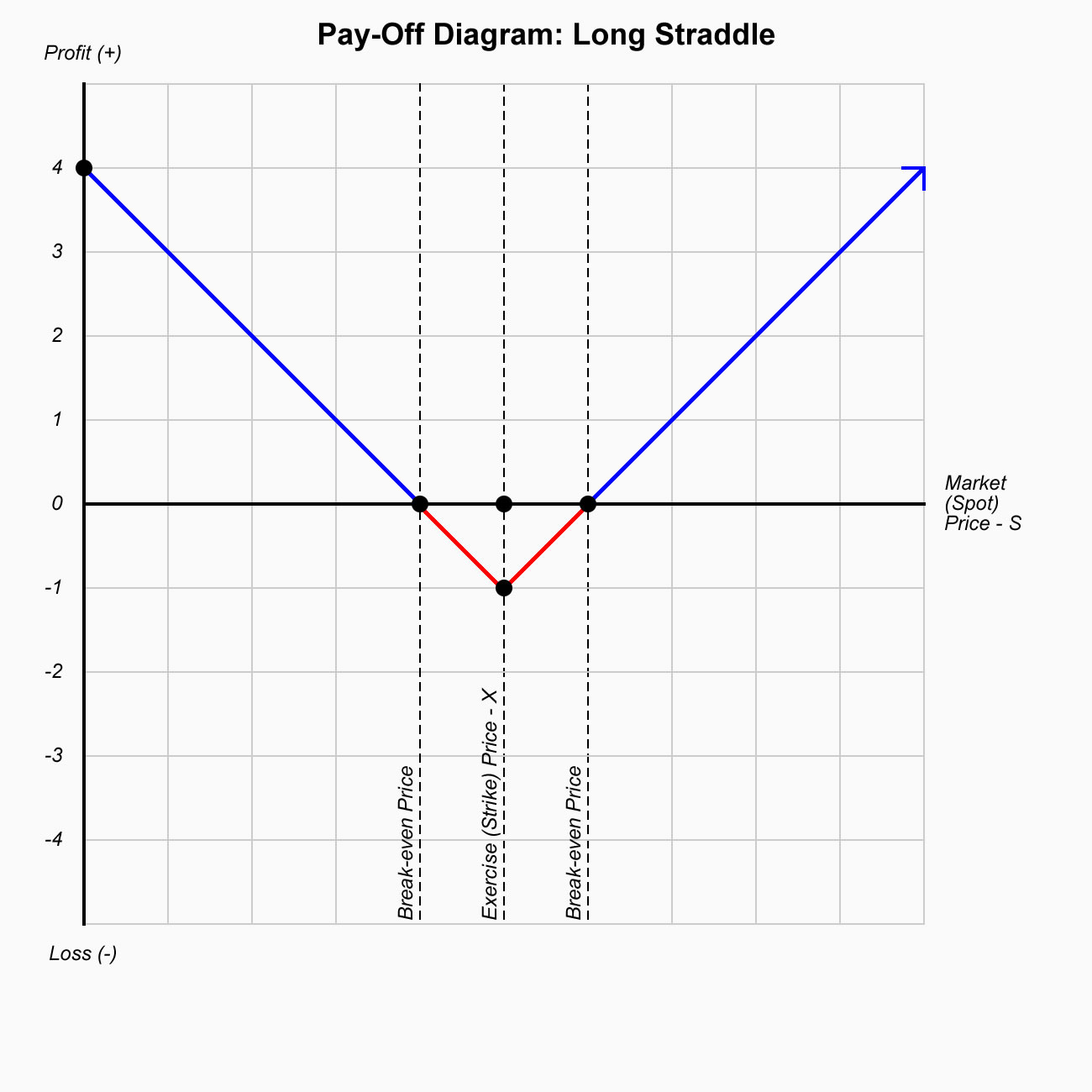

Long Straddle

- Strategy: Neutral

- Conditions: High Volatility

- Buy:

- Time Decay: Negative impact

- Break Even Points: Long Call – Premium, Long Call + Premium

- Max. Loss: Limited

- Max. Profit: Unlimited

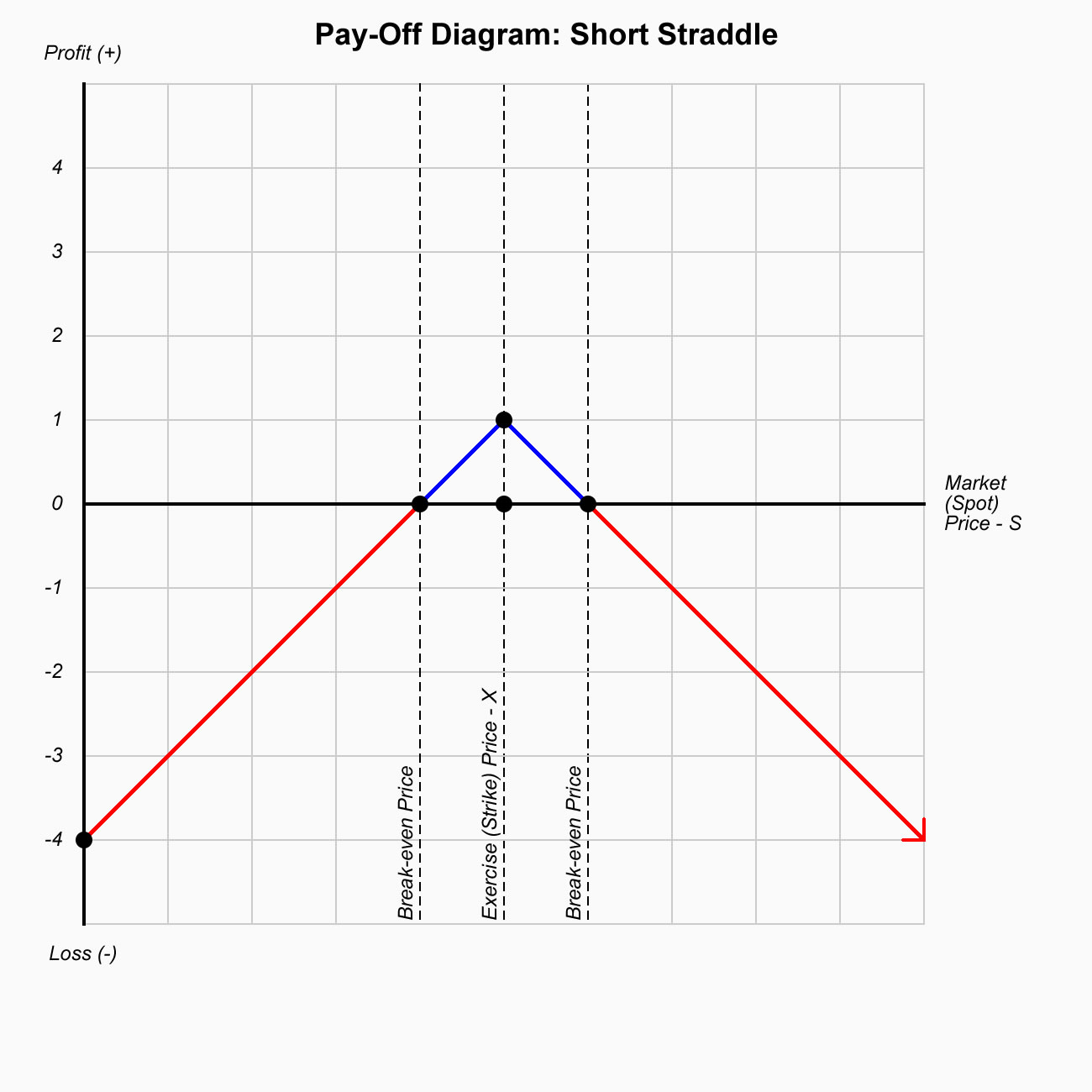

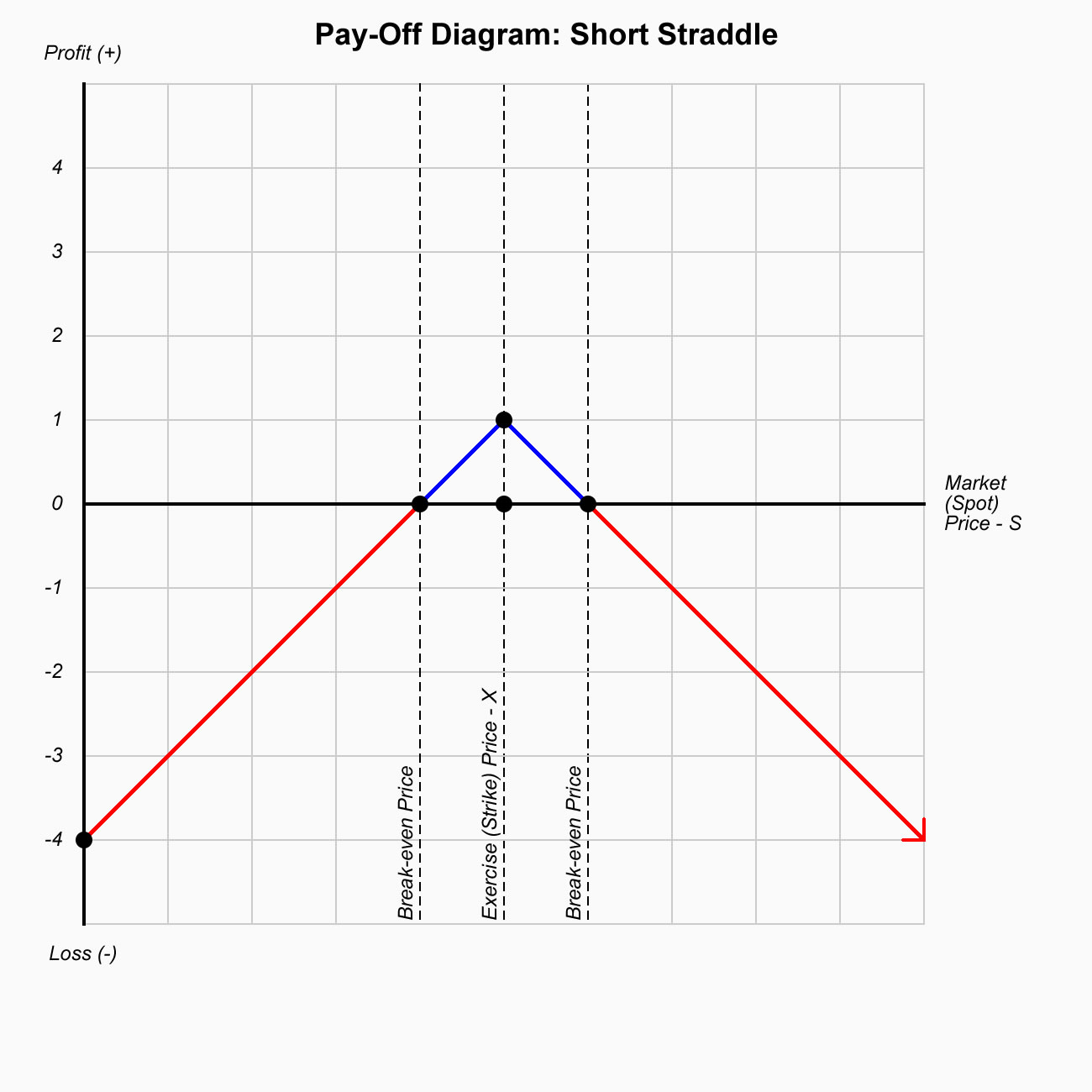

Short Straddle

- Strategy: Neutral

- Conditions: Low Volatility

- Sell:

- Time Decay:

- Break Even Points:

- Max. Loss: Unlmited

- Max. Profit: Limited

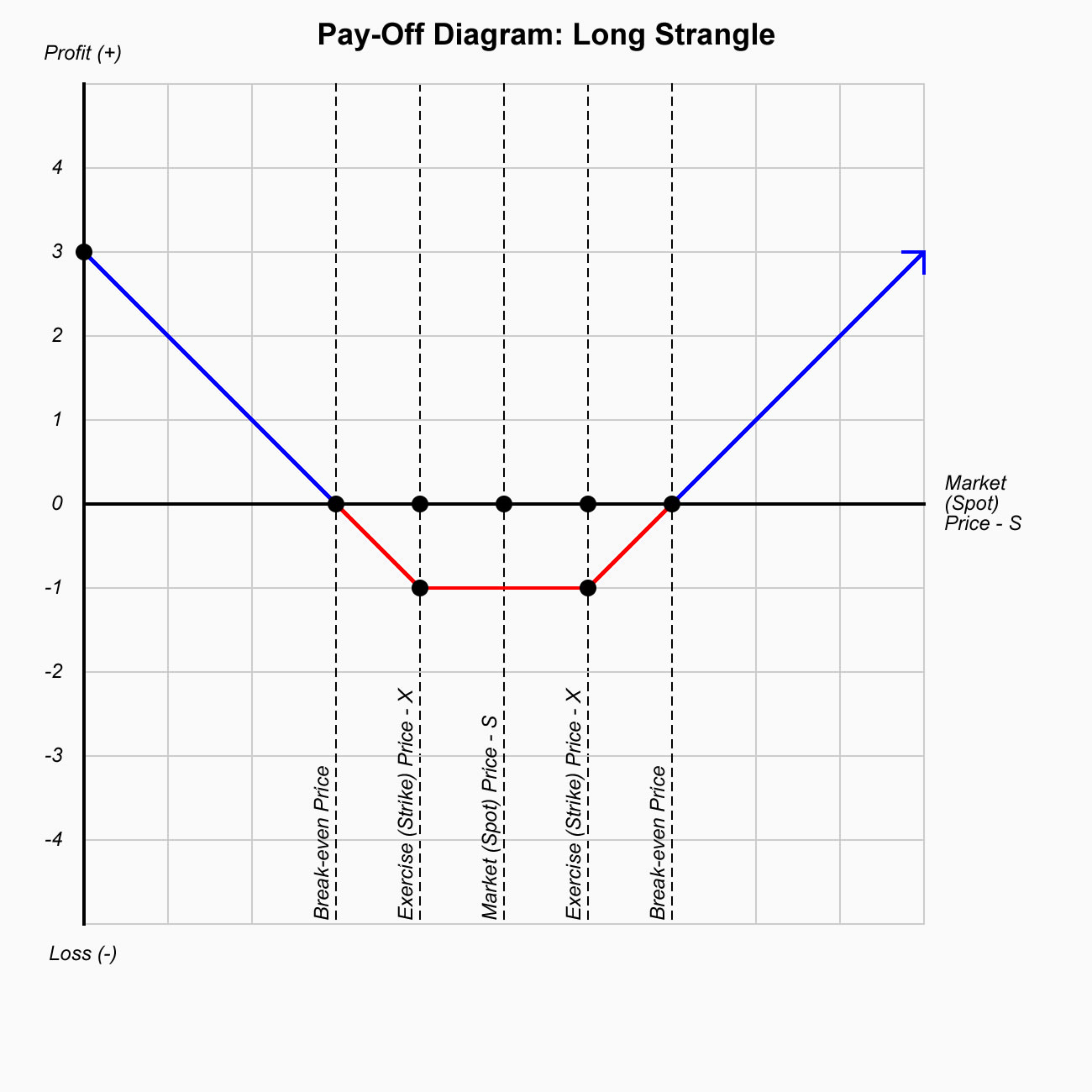

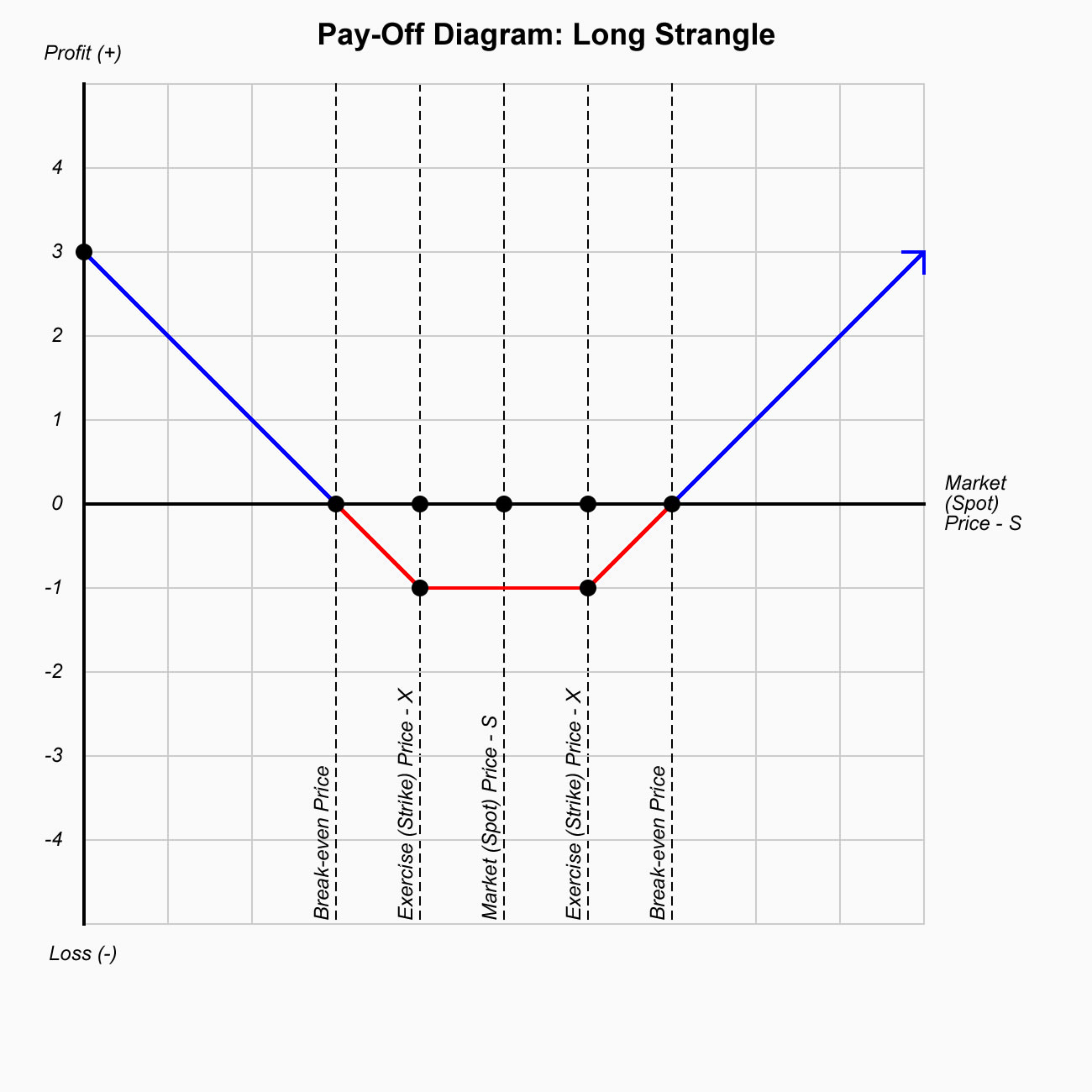

Long Strangle

With this strategy, a trader is looking for a major move; either up or down in the underlying stock before expiration. This market neutral strategy is specifically designed for high volatility conditions where stocks are swinging wildly back and forth.

- Strategy: Neutral

- Conditions: High Volatility

- Buy:

- Time Decay:

- Break Even Points:

- Max. Loss: Limited

- Max. Profit: Unlimited

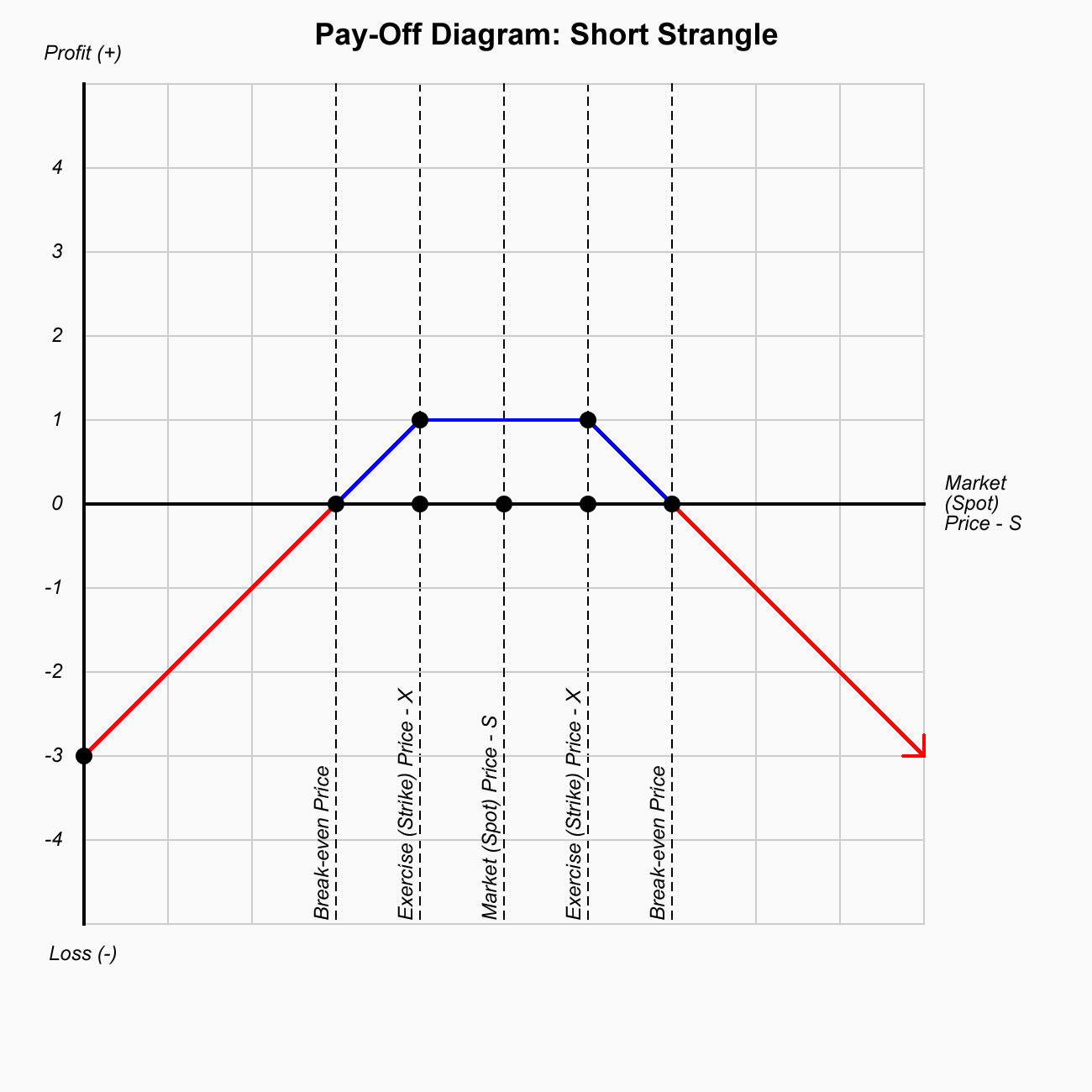

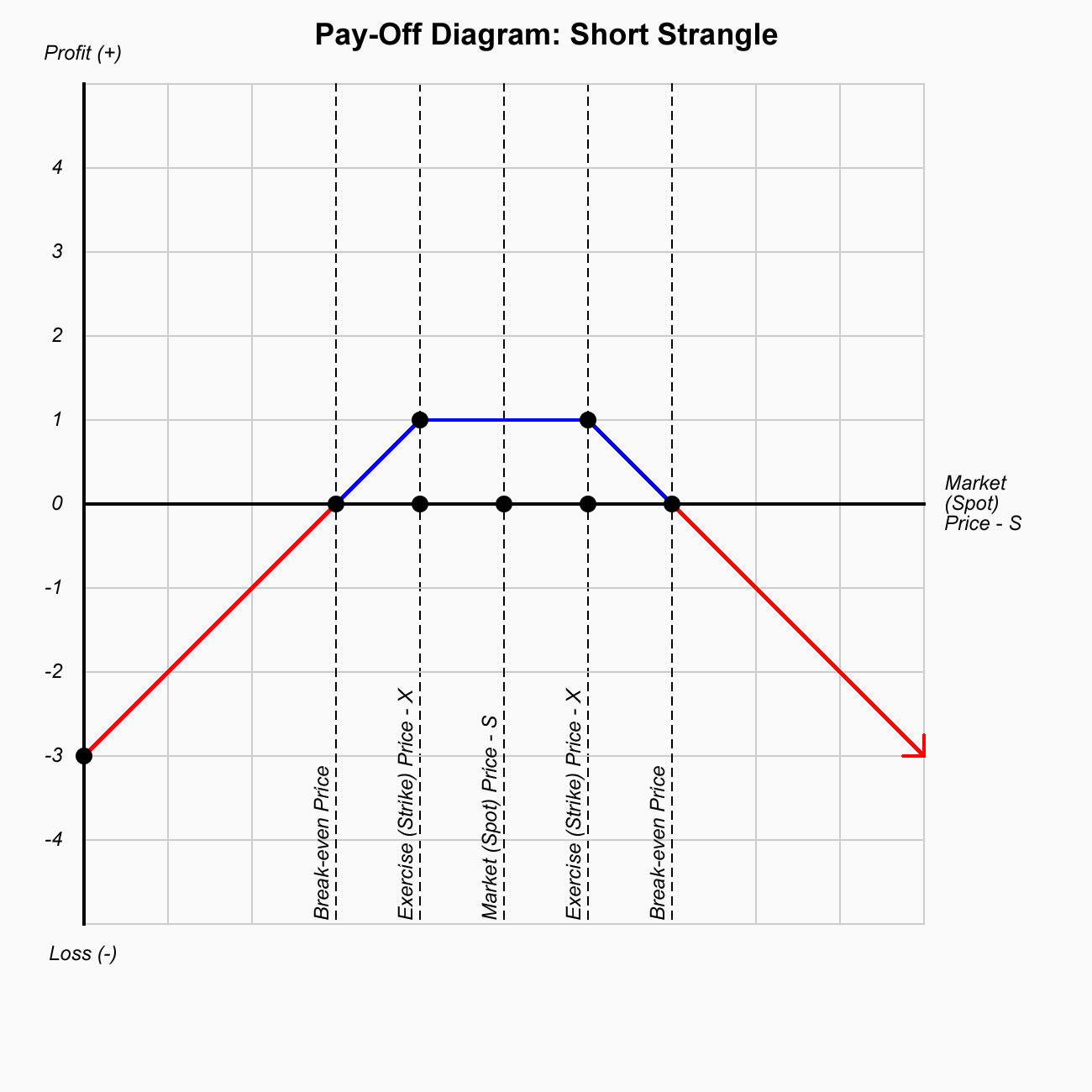

Short Strangle

- Strategy: Neutral

- Conditions: Low Volatility

- Sell:

- Time Decay:

- Break Even Points:

- Max. Loss: Unlimited

- Max. Profit: Limited

aaa